Kristallnacht, or simply Pogromnacht, occurred 80 years ago on November 9-10, 1938. The Pogrom was…

Making Decisions in the Face of Uncertainty

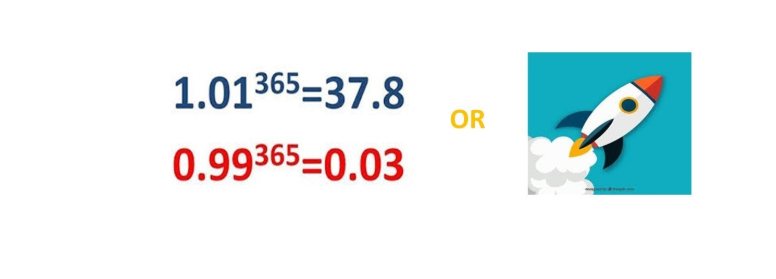

Unlike physics, finance does not merely reflect a mechanistic exchange. It is also a social science subject to a reflexive feedback loop. We influence the system and our actions are influenced by the system. So how to deal with a world with so much VUCA (volatility, uncertainty, complexity, & ambiguity)?

The left brain approach allows us to crunch data through the use of algos and analytics. This approach works as long as the world behaves within the model parameters. The right brain approach views the VUCA world with a lot more contextuality, adapting and absorbing new information more quickly. This approach is guided by investment processes just not controlled by them.

The question becomes how to increase our decision making when relevant information is often dynamic, unavailable, unknown, or unclear? Thales, one of the Seven Sages of Greece provides a clue. Thales bought all the olive presses in Miletus after predicting the weather and a good harvest. Another version has Aristotle explaining that Thales reserved presses in advance, at a discount, and could rent them out at a high price when demand peaked. The 1st version might constitute the first use of futures, whereas the 2nd version might be the first known creation of options.

I am not specifically advocating for the use of financial derivatives. I am advocating for investment thinking that recognizes that even if computing power can help us benefit from conditions that are non-linear, multi-factorial and multilateral, humans are not quarks. Algos beware!